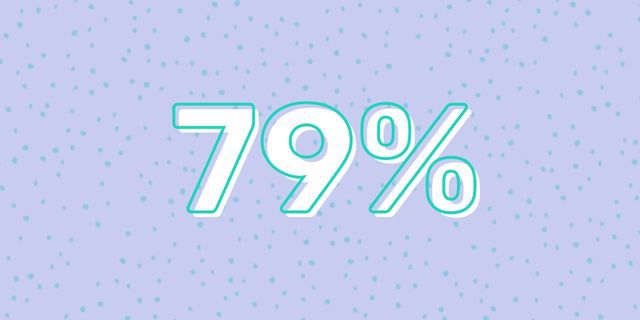

That’s how many people in the US think it’s a bad time to buy a house—the most for any month in the 12 years Fannie Mae has been polling.

A little over a year ago about as many people were positive as negative about homebuying, despite steep increases in sale prices stemming from a pandemic housing craze. But that’s when mortgage rates were near record lows, and this year alone they’ve spiked over 2 percentage points to reach levels not seen in over a decade. Affordability went from bad to worse this spring with newly purchased homes costing hundreds of dollars a month more just as rampant inflation stretched household budgets.

Consumers’ ever-more-dismal attitudes add to recent evidence that a major shift is underway in the hot housing market of the COVID-19 period. With so many things going against buyers, many are giving up on house hunting. Interest in mortgages and refinancing has plummeted to the lowest level in decades, and fewer homes are selling. That in turn, should slow the rate of price increases, cooling the market, some economists predict.

Pessimism about buying has been on an upward trajectory for over a year but has shot up in the last few months, reaching the 79% in May, according to the mortgage giant’s poll of 1,000 consumers, conducted since 2010. Conversely, a record low 17 % of people surveyed said it was a good time to buy.

Have a question, comment, or story to share? You can reach (Reporter name) at [email protected].

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!